Flood Insurance Coverage Rules Kick In for Citizens

Flood insurance coverage is now required as of April 1, 2023, for new Citizens personal residential policies that include wind coverage for covered property within the special flood hazard area. The requirement to secure and maintain flood coverage for Personal Lines residential policies will be phased in for all such policyholders over the next four years under a plan the Florida Legislature approved in December.

The flood insurance requirements are part of an overarching reform package intended to stabilize a Florida property insurance market rocked by high litigation costs and skyrocketing premiums over the last several years.

The flood insurance requirements apply only to Citizens policyholders who have a Personal Lines residential policy. While your agent will be in the best position to guide you through the process, here is a quick rundown.

New Personal Lines residential policyholders seeking Citizens coverage, including coverage for the peril of wind, in areas designated by the Federal Emergency Management Agency (FEMA) as a Special Flood Hazard Area are required as of April 1, 2023, to have flood insurance coverage to be eligible for a Citizens policy. Existing Citizens policyholders in designated FEMA flood hazard areas whose policy includes wind coverage will be required to have flood insurance to renew their Citizens policies on or after July 1, 2023.

For all other Citizens Personal Lines residential policies that include wind coverage, the flood insurance requirement will be phased in for new and renewing policyholders over the next four years as follows:

* January 1, 2024, for policies insuring property valued at $600,000 or more

* January 1, 2025, for policies insuring property valued at $500,000 or more

* January 1, 2026, for policies insuring property valued at $400,000 or more

* January 1, 2027, for all other policies

Citizens does not provide flood insurance, and flood coverage is not provided under standard multiperil policies. Requiring flood coverage better protects you from potentially expensive out-of-pocket repairs. Federally backed mortgages typically require flood insurance for properties located within flood zones.

In 2022, approximately 18% of Florida homeowners carried flood insurance. Coastal residents are far more likely to carry it, with well more than 50% of policyholders carrying flood insurance in the hardest-hit coastal counties impacted by Hurricane Ian in September 2022.

If you don’t wish to purchase flood insurance, you will not be eligible for a Personal Lines residential policy with Citizens. Contact your agent to discuss options that may be available within the private insurance market. Private policies that may offer more comprehensive coverage now might be comparably priced. Remember, Citizens’ policyholders are subject to a potential assessment of up to 45% of their premium following a major storm or series of storms.

Spring Advocacy Meeting 2023

We had the pleasure of attending the Florida Peninsula / Edison Spring Advocacy Meeting in Marathon, FL.

Alan Hanbury is a Member of Florida Peninsula's Advisory Committee, which helps support client concerns with a top-rated insurer.

Price of Paradise: Roof repair schemes, runaway litigation push Florida insurers to the brink

Rates will keep rising as legislators work to control lawsuits filed by roofing contractors

By: Michael Paluska via ABC News

WHAT IS THE PRICE OF PARADISE?

As Tampa Bay continues to attract new residents and businesses, the impact of living in paradise comes at a cost for all of us— from the increasing cost of housing and infrastructure to utilities and insurance. ABC Action News is committed to helping you and your family make the most of your money and navigate through the Price of Paradise.

TAMPA, Fla. — Homeowner's insurance rates will continue to go up for at least two more years as legislators work to control lawsuits filed by attorneys on behalf of roofing contractors.

Many people will be surprised to learn Florida's homeowner's insurance woes that we are currently facing are getting fueled by something other than inclement weather.

"These are not storm-related losses that are impacting Florida homeowners," Mark Friedlander, Director of Corporate Communications at the Insurance Information Institute, told ABC Action News reporter Michael Paluska.

"What we're seeing are some ongoing issues that we've been trying to address with the state legislature for several years. Rampant roof repair schemes, really roof repair fraud schemes, and tied into that runaway litigation filed by a select group of attorneys across the state."

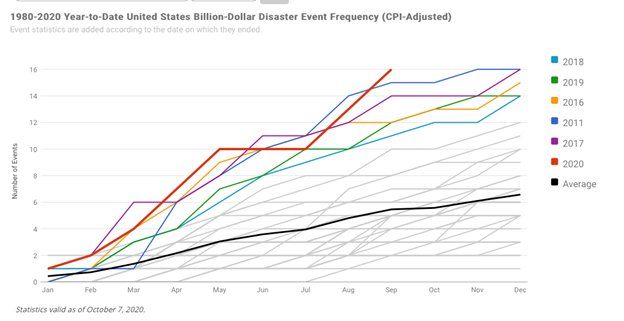

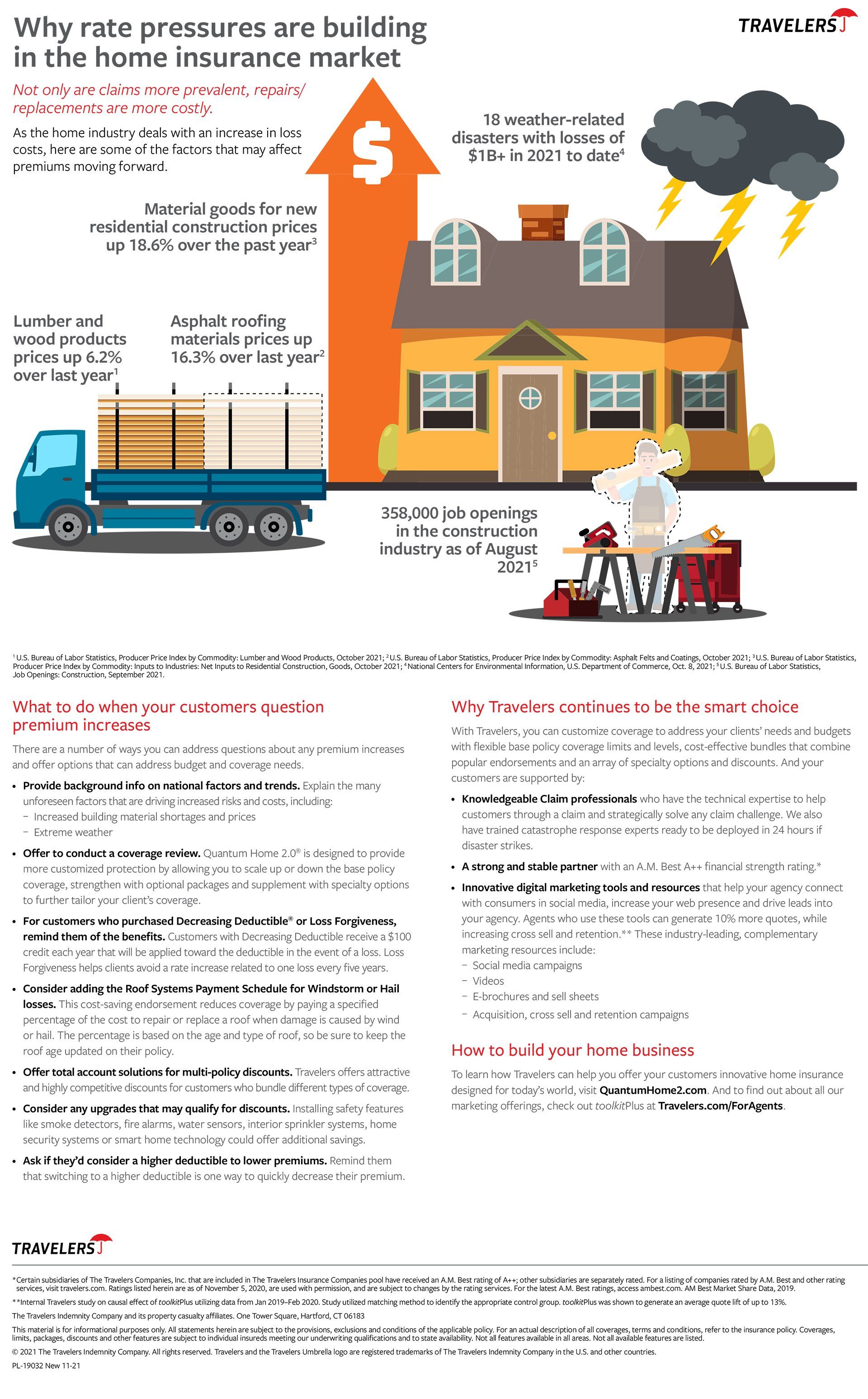

Wildfires, hurricanes, disastrous floods, tornadoes and snowstorms have all taken their toll on the industry.

According to the National Oceanic and Atmospheric Administration, "the U.S. has sustained 310 weather and climate disasters since 1980, where overall damages/costs reached or exceeded $1 billion (including CPI adjustment to 2021). The total cost of these 310 events exceeds $2.155 trillion."

But, industry analysis shows Florida's storm is something entirely different, and the financial impacts to all of us are staggering.

"If a roofer comes knocking on your door and promises you a free roof that will be covered by your insurance, it's time to say no thank you and close the door," Friedlander said. "Because what's happening is that's not only going to impact you personally down the road. It is impacting all your friends, neighbors, and relatives; everybody is paying for your free roof."

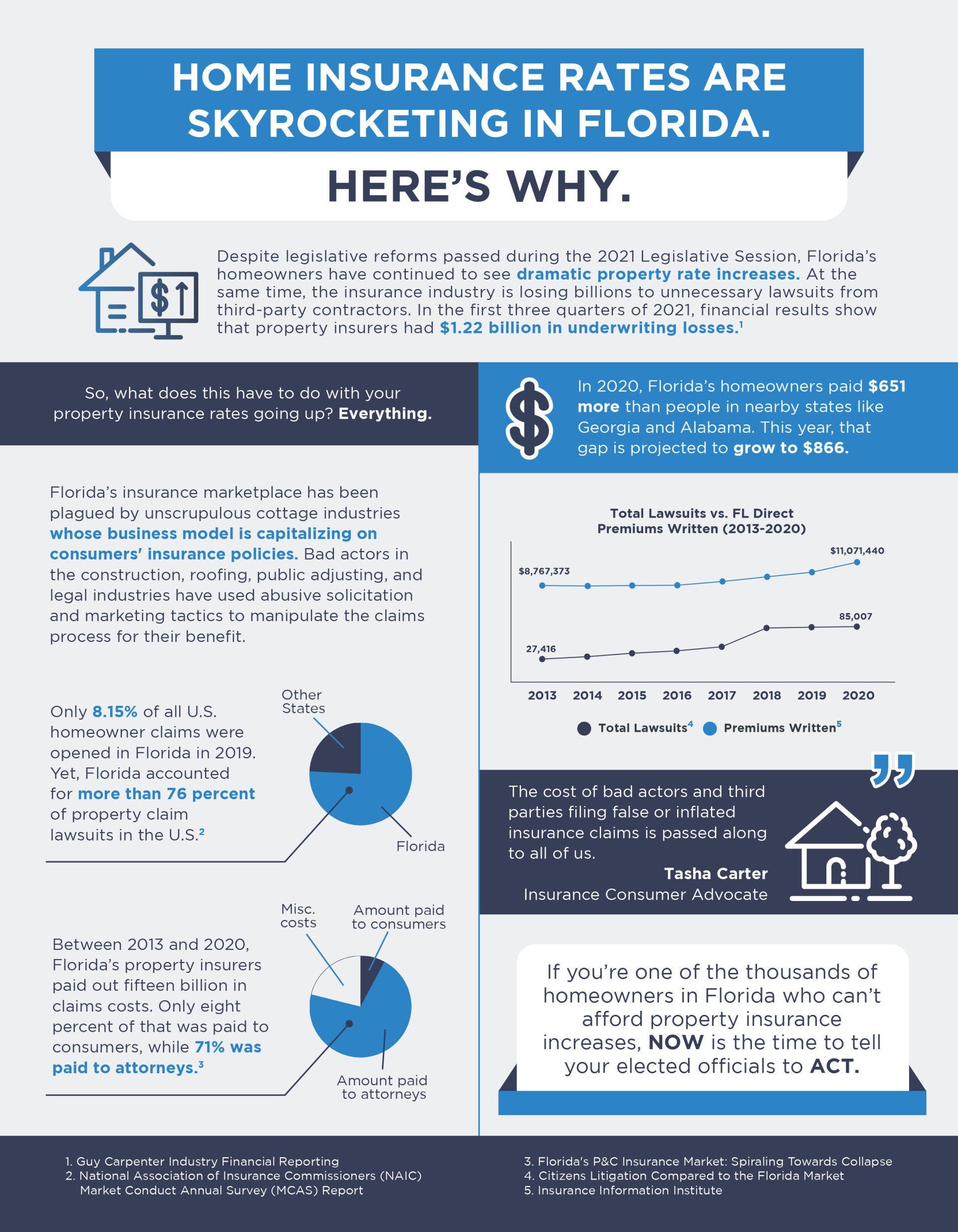

The insurance industry is losing billions to unnecessary lawsuits from third-party contractors. According to Guy Carpenter Industry Financial Reporting, in the first three quarters of 2021, financial results show that property insurers had $1.22 billion in underwriting losses.

Between 2013 and 2020, Florida's property insurers paid out $15 billion in claims costs. Only 8% percent of that was paid to consumers, while 71% was paid to attorneys. That is more than $10 billion. Floridians are now spending an average of $3,600 a year for homeowners insurance, double the national average.

"Let's just give an example, $100,000 settlement $70,000 is going to the attorney, and maybe the other $30,000 is going to the roofing contractor. The policyholder is not even involved," Friedlander said. "So what may be just, say a $5,000 to $10,000 repair to a roof could run well into six figures."

Last summer, Florida Gov. Ron DeSantis signed a bill to curb litigation. The new law forbids contractors from soliciting homeowners to file roofing claims. The law also narrows the time frame in which homeowners can file claims.

"In fact, we're seeing the opposite impact, and we're seeing more roof solicitations, door to door solicitations, than ever before. And we're seeing a rise in related litigation," Friedlander said.

Insurance agents say more needs to be done to stop the problem. Jeff Italiano, the owner of Italiano Insurance in Tampa, explained how roofers and lawyers are pulling this off.

"It's called assignment of benefits, AOB, that's when a homeowner signs his rights away to a roofer, and then the roofer goes after the insurance company for all they can get," Italiano said. "Many insurance companies have now put in their policy forms in their contract that you cannot assign your benefits cause when people assign their benefits, they are getting taken advantage of."

Italiano said his office is now slammed with residents trying to find new insurers. In 2021, more than 50,000 policyholders were dropped. Italiano expects that trend to continue. And more and more people are getting pushed into what Italiano calls "the insurer of last resort," state-run Citizens Property Insurance Corporation.

"But, what's happening now as the insurance companies have to raise their rates, and in many cases, Citizens might be cheaper. So, people are flocking back to Citizens, The problem with Citizens is that it's underfunded. So if we have a big loss, there may not be enough money to pay all the claims."

Citizens is currently receiving about 4,100 new policies a week, an average over the past five weeks. That is likely to go up to about 4,500 to 5,000 per week.

"Despite the rapid increase in policies, Citizens remains in a strong financial position. We have a $6.5 billion surplus. We also purchase reinsurance and sell bonds on the global market to help protect that surplus. Citizens is in a position to handle a 1-100 year storm without exhausting its surplus and having to levy assessments," Michael Peltier, Media Relations Manager for Citizens, told Paluska in an e-mail.

"Such a storm, however, would eat up a significant amount of our surplus. If Citizens exhausts its surplus following a major storm or series of storms, it has the ability to levy assessments on its policyholders and other Florida insurance consumers to pay claims. As such, we remain able to pay claims even if our surplus is exhausted."

Peltier added that the private market is key to protecting homeowners in the future.

"Citizens Chairman Carlos Beruff and Citizens President/CEO Barry Gilway have both made it clear that the current trend in policy increases is unsustainable. In the long term, a healthy private insurance market is the best solution," Peltier said.

Unless Florida legislators fix the runaway litigation, industry experts worry what a storm impacting our state in 2022 could do to our public and private insurance market.

"If we saw a major storm, a major catastrophe, or hurricane-level catastrophe, there could be other insurers that go insolvent in Florida," Friedlander said.

Top 5 Myths About Homeowners Insurance

By Dan DiClerico via HomeAdvisor.com

Myth #1: Flooding is covered by standard homeowners insurance

While natural disasters like hurricanes, blizzards and tornadoes are covered, flooding is not. That’s a problem since flooding is now one of the most common and costly types of natural disaster in the U.S., thanks to changing weather patterns and the fact that more homes are being built near large bodies of water. “People are in denial over flood risk,” says III spokesperson Lynne McChristian.

What to do?

Even if your risk of flooding is low, consider supplement flood insurance. According to the National Flood Insurance Program, more than 20 percent of flood claims come from properties outside the high-risk flood zone. The average homeowner spends $700 for a flood insurance policy. Contact the NFIP Referral Call Center at 1-800-427-4661 for more details.

Myth #2: All belongings in the home are covered

Standard insurance policies do cover personal belongings, including clothing, furniture and sports equipment. However, very valuable items, say that diamond-encrusted Rolex watch or Saint Laurent evening dress, are subject to limits. As a result, you might only get $1,500 or so even on lost items that are worth many times that amount.

What to do?

To have valuables insured to their full value, they will need to be “scheduled,” a process that involves having them appraised and assigned to a special policy, known as a personal property endorsement or floater. This information should be included in the home inventory that insurance companies advise keeping for all of your possessions.

Myth #3: If a home is destroyed, the insurance will cover its current market value

Let’s say your home is leveled in a hurricane. If it was worth $500,000 at the time, you might assume that’s how much the insurance company will pay you. But in fact, insurance is tied to the cost to rebuild the home, not its market value. That could result in a rude awakening. “Rebuilding costs continue to rise because the cost of labor and raw materials are both increasing,” says McChristian. If you live in an older home, it will need to be reconstructed according to current building codes, which could drive costs up even further.

What to do?

Have an annual call with your insurance provider to make sure your coverage is enough to cover the full cost to rebuild. Any premium increases will likely be minor, but they’ll make a huge difference in the event of a catastrophe.

Myth #4: Renters are covered by their landlord’s policy

If you rent an apartment in your landlord’s home and it burns to the ground or gets hit by thieves, their insurance won’t do anything for your lost possessions. Unfortunately, only about 40 percent of renters in the U.S. have renters insurance, compared to 93 percent of homeowners.

What to do?

If you rent a home, purchase renters insurance; the average premium is $182, so it’s not a major financial burden. And if you’re a landlord, require tenants to carry insurance to avoid surprises in the event of a disaster or theft

Myth #5: Mold, termites, and other infestations are covered.

Mold and termites can both wreak havoc on a home, rendering it unlivable in a worst-case scenario. And your insurance company won’t pay a dime to help. That’s because these infestations are considered maintenance issues and it’s up to you to care for your home properly.

What to do?

Be on the lookout for any kind of outbreak in the home. Mold thrives in damp areas, so use a dehumidifier if necessary to keep humidity levels between 30 and 60 percent. Termites often leave cast-off winds along walls and windowsills. The cost to treat termites is around $500, compared with the tens of thousands you might have to pay if the critters ravage your home’s structure.

As with homeowners insurance, it’s all about being safe, rather than sorry.

Why Florida Homeowners Insurance Is Going Up and What You Can Do to Help

Many Florida homeowners are seeing their premiums go up, including policyholders who have never filed a claim. The experience can be frustrating and hard to understand. What’s to blame?

While storm severity and frequency have caused insurance rate increases, so has insurance fraud. Fortunately, there are things Floridians like you can do to curb insurance fraud:

- Educate yourself about insurance fraud

- Don’t become an Assignment of Benefits (AOB) victim

- Protect your pocketbook from shady contractors

- Contact your legislators

What You Can Do to Help

The Florida legislature is considering proposals to address the fraud and abuses in the system that drive up costs.

Contact Governor Ron DeSantis, House Speaker Chris Sprowls, and Senate President Wilton Simpson today to express support for property insurance litigation and fraud reforms now!

Call Governor Ron DeSantis at 850-717-9337

Call Speaker of the House Chris Sprowls at 850-717-5000

Call Senate President Wilton Simpson at 850-487-5229

Make your voice heard and tell the Florida Legislature to bring insurance claim fraud and abuse under control.

Here is some information to help you be an informed policyholder:

Why Is Florida Homeowners Insurance Going Up?

There are several factors causing homeowners insurance rates to go up across Florida. People’s Trust Insurance looks at the ways these factors are impacting your premiums and what you can do about it in Why Is Florida Homeowners Insurance Going Up?

Florida Home Insurance Rates to Significantly Increase in 2021

Fraudulent contractors in Florida significantly impact the state’s insurance rates. How? They create additional costs that ultimately increase insurance rates for policyholders like you. Get more details on why home insurance rates in Florida will significantly increase next year.

Protecting Your Pocketbook

The Consumer Protection Coalition created a guide to help protect Florida homeowners like you from Assignment of Benefits (AOB) fraud and abuse, including knowing the risks of signing an AOB and how to avoid becoming an AOB scam victim. Download the Consumer Protection Coalition’s quick guide on how to avoid falling victim to Assignment of Benefits fraud and abuse.

Report Home Repair Fraud

If you suspect fraud, notify your home insurance company immediately and report it to the Florida Division of Insurance Fraud, either online or by calling toll-free 800-378-0445. Get your free guide to AOB fraud today.

But, to really make a difference, contact your legislators today to express support for property insurance litigation and fraud reforms now.

FL Homeowners Insurance Rate Increases

January Principal Message (New Years Focus)

By Alan Hanbury

- Grow Millennium Insurance

- Give everyday 100%

What Our Clients Say

By Alan Hanbury

Join Our Referral Program

By Alan Hanbury

Newsletter 11/12/2020

By Kendall Ganey

Newsletter 11/01/2020

By Kendall Ganey

Newsletter 10/12/2020

By Kendall Ganey

October Newsletter

By Alan Hanbury

Halloween Safety

By Alan Hanbury

Staff Birthday Announcement

By Alan Hanbury

Newsletter 09/01/2020

By Kendall Ganey

- Full names of everyone on policy, plus date of births, and drivers’ license numbers. Insurance companies’ run driver reports for all drivers. If the insurance company is unable to verify the information you will be charged more because they are unable to see if you have a clean driving record.

- Have any of the drivers had any accidents or claims in the past 5 years? Insurance agents ask for this information because companies give you safe driver discounts if you have not had any claims. If you do not let the agent know about an accident and claim, the quoted amount could take a huge increase once they run your driving reports.

- How long have you been with your current auto company? Some companies give you a loyalty discount if you have been with your current company over 5 years. This will be verified when auto reports are run.

- Are you a homeowner? Let the agent know… this is a discount on your auto policy. Or they might be able to bundle your home and auto for a bundled discount.

- Make sure you have all your vin numbers. With the correct vin numbers the agent will be able to make sure you have all your safety rating credits to save you money.

- Your current coverages. All agents should ask what your current coverages are. This will allow the agent to do an apple to apples quote. If they do not ask for this information, there is a good chance they will quote you with lower coverages than you have now to win your business at a lower rate.

- Have you taken a senior (defensive) safety driver class? This will add a small discount to your policy. You will have to show proof (certificate of class completion) to get the discount.

- If your kids are still in school and they have a GPA of 3.2 or higher, let your agent know. This is a nice reward for the parents when your kids do good in school. More money in your pocket for college.

Newsletter 08/20/2020

By Kendall Ganey

Newsletter 08/01/2020

By Alan Hanbury

Newsletter 07/27/2020

By Kendall Ganey

Newsletter 07/13/2020

By Kendall Ganey

Summer is Here! By Alan Hanbury

Join Our Referral Program By Alan Hanbury

Newsletter 07/01/2020

By Kendall Ganey

Work from Home Tips By Alan Hanbury

- Stick to a schedule and work your regular hours

- Schedule virtual meetings with coworkers

- Take breaks & Go outside for fresh air

Happy Father's Day By Alan Hanbury

Shelter Cat Awareness Month

By Alan Hanbury

Our Facebook Feed

Bradenton Location

Bradenton, Florida 34209

Sarasota Location

Sarasota, Florida 34232

Saint Augustine Location (Remote)

St. Augustine, Florida 32080